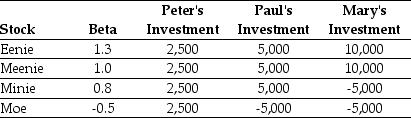

Use the table for the question(s) below.

Consider the following three individuals' portfolios consisting of investments in four stocks:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then required return on Peter's portfolio is closest to:

Definitions:

Best Current Estimate

An accurate projection or valuation of an entity's financial condition at the present moment, considering all known facts.

Breakeven Analysis

A financial calculation to determine the number of products or services a company must sell to cover its costs.

Cumulative Dollar Value

The total monetary value of something accumulated over time.

Investment

The action or process of allocating resources, usually money, with the expectation of generating an income or profit.

Q7: Which of the following statements is false?<br>A)

Q20: Which of the following statements is false?<br>A)

Q22: Risk-neutral probabilities are known by other names

Q22: Consider an equally weighted portfolio that contains

Q25: Debt betas tend to be _,though they

Q26: A portfolio is efficient if and only

Q36: Which of the following statements is false?<br>A)

Q62: Investment strategy that _ stocks that have

Q65: It is only those risks that _

Q79: If KT expects to maintain a debt-to-equity