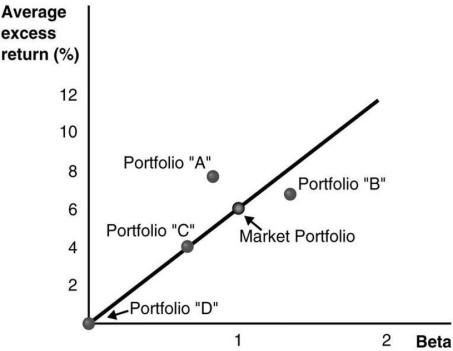

Use the figure for the question(s) below.Consider the following graph of the security market line:

-Portfolio "A":

Definitions:

Dirty Harry Problem

A moral and ethical dilemma faced by law enforcement officers when they consider violating rules or ethical standards to achieve a just outcome, particularly in cases where conventional methods are ineffective.

Unethical

Actions or behaviors that violate moral principles or standards of conduct accepted by a given society or profession.

Desirable Ends

A concept in ethics and philosophy that refers to outcomes or goals considered beneficial or preferable based on moral, ethical, or societal standards.

Police Interrogations

The process by which police officers question suspects or witnesses in a criminal investigation to gather information and evidence.

Q19: As most homeowners know,in Canada mortgage interest

Q22: Which of the following statements is false?<br>A)

Q32: Using the data provided in the table,calculate

Q45: Which of the following statements is false?<br>A)

Q52: The average annual return on the S&P

Q54: An over-investment problem means that shareholders have

Q66: Which of the following statements is false?<br>A)

Q71: There is an important difference between the

Q76: The amount of Rosewood's interest tax shield

Q95: Assume that you purchased Ford Motor Company