Use the table for the question(s) below.

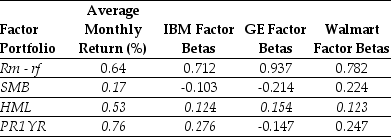

Consider the following information regarding the Fama-French-Carhart four factor model:

-Using the FFC four factor model and the historical average monthly returns,the expected monthly return for IBM is closest to:

Definitions:

Fixed Selling

Costs that remain constant regardless of the volume of goods or services sold.

Direct Labor-Hours

The total hours worked by employees that are directly involved in the manufacturing process.

Raw Materials Cost

The expense of materials that are used in the manufacturing process to create goods, not yet processed or altered.

Direct Labor Wage

The remuneration paid to employees who are directly involved in the production of goods or the provision of services.

Q1: Which of the following statements is false?<br>A)

Q30: The idea that managers who perceive the

Q33: Suppose that the risk-free rate is 5%

Q48: As the case of Air Canada demonstrates,firms

Q49: The required net working capital in the

Q52: The average annual return on the S&P

Q53: Suppose that you want to use the

Q55: Which of the following statements is false?<br>A)

Q70: Which of the following statements regarding portfolio

Q94: Which of the following investment opportunities provides