Use the table for the question(s) below.

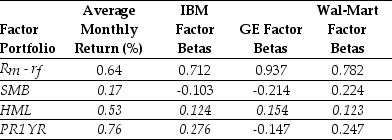

Consider the following information regarding the Fama French Carhart four factor model:

-Using the FFC four factor model and the historical average monthly returns,the expected monthly return for Wal-Mart is closest to:

Definitions:

APR Interest

Annual Percentage Rate; the annual rate charged for borrowing or earned through an investment, which includes any fees or additional costs associated with the transaction.

Received Monthly

Regular payments or incomes that are received every month, often related to salaries, benefits, or recurring revenue streams.

Received Quarterly

Pertaining to events or payments that occur once every three months.

Thirty Year Mortgage

A long-term mortgage loan typically repaid over a period of 30 years, with fixed or variable interest rates.

Q18: If Flagstaff currently maintains a debt to

Q25: When a Canadian firm uses debt,the interest

Q32: Using the data provided in the table,calculate

Q33: Suppose that the risk-free rate is 5%

Q34: Which of the following statements is false?<br>A)

Q57: The term ε is a(n)<br>A) measure of

Q57: You want to maximize your expected return

Q61: The yield to maturity of a bond

Q74: The Canadian S&P/TSX Composite Index is a

Q75: Which of the following statements is false?<br>A)