Use the information for the question(s) below.

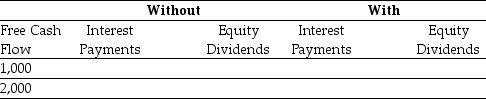

Consider two firms: firm Without has no debt, and firm With has debt of $10,000 on which it pays interest of 5% per year. Both companies have identical projects that generate free cash flows of $1,000 or $2,000 each year. Suppose that there are no taxes, and after paying any interest on debt, both companies use all remaining cash free cash flows to pay dividends each year.

-Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows:

Definitions:

Stamina

The ability to sustain prolonged physical or mental effort.

Football Players

Athletes who specialize in playing the sport of football, which involves team strategies to move a ball into the opposition's goal area to score points.

Smoking Cigarettes

The act of inhaling and exhaling the smoke produced by burning tobacco in rolled paper.

Q3: Following the borrowing of $12 million and

Q5: Which of the following statements is false?<br>A)

Q23: Once a company goes public,it must satisfy

Q27: Consider the following equation: C = S

Q30: Which of the following is NOT considered

Q36: Which of the following statements regarding portfolio

Q43: Luther's unlevered cost of capital is closest

Q45: Assuming that Kinston has the ability to

Q47: Which of the following statements is false?<br>A)

Q59: The cost of capital for a project