Use the information for the question(s) below.

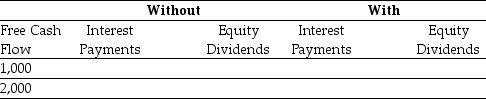

Consider two firms: firm Without has no debt, and firm With has debt of $10,000 on which it pays interest of 5% per year. Both companies have identical projects that generate free cash flows of $1,000 or $2,000 each year. Suppose that there are no taxes, and after paying any interest on debt, both companies use all remaining cash free cash flows to pay dividends each year.

-Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows:

Definitions:

Delusions

False beliefs held despite strong evidence against them, often seen in psychiatric conditions such as schizophrenia.

FBI Agents

Individuals employed by the Federal Bureau of Investigation, responsible for investigating federal crimes.

Laughing

A physical and emotional response that involves a series of rhythmic, vocalized, often involuntary actions, usually expressing amusement.

MBO Programs

"Management by Objectives" programs, a strategic management model where employees and managers collaboratively set, track, and achieve specific objectives for better organization performance.

Q2: If Rosewood had no interest expense,its net

Q3: The beta on Peter's portfolio is closest

Q4: Which of the following is NOT one

Q12: The _ cost of debt to the

Q21: Using risk-neutral probabilities,calculate the price of a

Q21: The cost of capital for a project

Q22: In Canada,_ usually takes the lead in

Q41: Which of the following equations is incorrect?<br>A)

Q71: There is an important difference between the

Q92: If there is a significant risk that