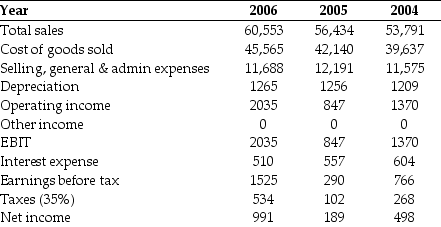

Use the table for the question(s) below.

Consider the following income statement for Kroger Inc.(all figures in $ Millions) :

-The interest rate tax shield for Kroger in 2004 is closest to:

Definitions:

Future Value

The value of an investment at a specified date in the future, considering factors like interest rates and time.

Present Value

The contemporary valuation of a future quantity of money or cash flow series, assuming a specific interest rate.

Annuity Due

A type of annuity payment where the payment is due at the beginning of each period, rather than at the end.

Expected Cash Flows

The projected amounts of money to be received or paid out by a business within a specified period.

Q12: Luther Industries currently has 100 million shares

Q15: Which of the following statements is false?<br>A)

Q19: What will the offer price of these

Q22: Consider an equally weighted portfolio that contains

Q30: Assuming that Kinston does not have the

Q43: A hyperbola curve represents the set of

Q43: Consider the following equation: C = S

Q70: In the flow-to-equity (FTE)valuation method,we explicitly calculate

Q74: The effective tax disadvantage for retaining cash

Q100: Assume that the S&P/TSX Composite Index currently