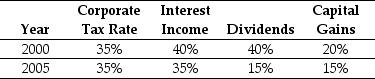

Use the table for the question(s) below.

Consider the following historical top federal tax rates in the United States:

Personal Tax Rates

-In 2005,the effective tax rate for debt holders was closest to:

Definitions:

Complementary Goods

Products or services that are used together, where the demand for one is increased when the price of the other decreases.

Demand Curve

An illustration that displays how the price of a product or service correlates with the amount people want to buy during a specific time frame.

Price

The amount in currency estimated, obligatory, or contributed as payment for something.

Quantity Demanded

The total amount of a good or service that consumers are willing and able to purchase at a given price within a specified time frame.

Q6: If Luther invests the excess cash in

Q11: The unlevered cost of capital for "Moe"

Q12: The _ cost of debt to the

Q20: Which of the following statements is false?<br>A)

Q20: Which of the following statements is false?<br>A)

Q22: How many of the January 2009 put

Q23: Which of the following statements is NOT

Q29: What is the Yield to Maturity (YTM)on

Q45: Which of the following statements is false?<br>A)

Q52: When you do not have the option