Use the information for the question(s) below.

KD Industries has 30 million shares outstanding with a market price of $20 per share and no debt. KD has had consistently stable earnings, and pays a 15% tax rate. Management plans to borrow $200 million on a permanent basis through a leveraged recapitalization in which they would use the borrowed funds to repurchase outstanding shares.

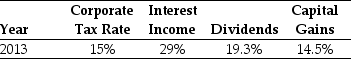

-Assume the following tax schedule:

Personal Tax Rates

Considering the effect of personal taxes,calculate the PV of the interest tax shield provided by KD's recapitalization.

Considering the effect of personal taxes,calculate the PV of the interest tax shield provided by KD's recapitalization.

Definitions:

Dishwashing

The process of cleaning cooking utensils, dishes, and other kitchenware, typically done manually by hand or using a dishwasher.

Absolute Advantage

The capacity of a nation, person, corporation, or area to generate a product or service at a cheaper per-unit expense than any other party.

Brownies

A type of chocolate cake that is typically baked in a square or rectangular shape.

Cookies

Small, usually sweet baked goods that are often made with flour, sugar, and some type of oil or fat.

Q3: Using risk-neutral probabilities,the calculated price of a

Q4: Which of the following is NOT one

Q5: Portfolio "D"<br>A) falls below the SML.<br>B) has

Q12: The open interest for a January 2009

Q16: Which of the following statements is false?<br>A)

Q27: What will the proceeds from the IPO

Q30: Assuming that Kinston does not have the

Q33: Which of the following statements is false?<br>A)

Q40: Which of the following statements is false?<br>A)

Q67: Assume that EGI decides to wait until