Use the information for the question(s) below.

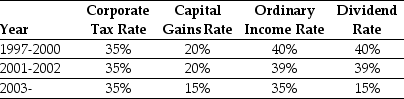

Consider the following tax rates:

The current tax rates are set to expire in 2008 unless Congress extends them. The tax rates shown are for financial assets held for one year. For assets held less than one year, capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ; the same is true for dividends if the assets are held for less than 61 days.

The current tax rates are set to expire in 2008 unless Congress extends them. The tax rates shown are for financial assets held for one year. For assets held less than one year, capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ; the same is true for dividends if the assets are held for less than 61 days.

-In 2006,Luther Industries paid a special dividend of $5 per share for the 100 million shares outstanding.If Luther had instead retained that cash permanently and invested it into Treasury Bills earning 6%,then the present value of the additional taxes paid by Luther would be closest to:

Definitions:

Operational Costs

Expenses associated with the day-to-day functioning of a business or organization.

Capacity

The maximum amount that something can contain or the ability of individuals or organizations to achieve their objectives.

Management Literature

A collection of writings and studies focused on theories, strategies, and practices involved in the management of organizations.

Academics

The broad domain concerned with the study, teaching, and research in disciplines of higher education, including but not limited to science, humanities, and social sciences.

Q4: Which of the following statements is false?<br>A)

Q6: Assume that Martin pays no premium to

Q7: Which of the following statements is false?<br>A)

Q14: An extremely lucrative severance package that is

Q15: When managers _ the dividend,it may signal

Q18: If Martin pays no premium to acquire

Q34: Which of the following statements is false?<br>A)

Q60: The intuition for the WACC method is

Q65: Which of the following statements is false?<br>A)

Q83: To determine the benefit of leverage for