Use the information for the question(s) below.

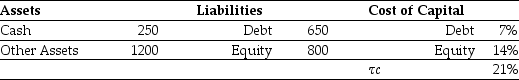

Iota Industries Market Value Balance Sheet ($ Millions) and Cost of Capital  Iota Industries New Project Free Cash Flows (Millions)

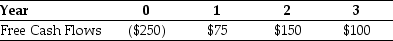

Iota Industries New Project Free Cash Flows (Millions)  Assume that this new project is of average risk for Iota and that the firm wants to hold constant its debt to equity ratio.

Assume that this new project is of average risk for Iota and that the firm wants to hold constant its debt to equity ratio.

-Iota's weighted average cost of capital is closest to:

Definitions:

Spending Variance

The difference between the actual amount spent and the budgeted amount for a particular category or period, indicating over or under spending.

Planning Budget

A financial plan that estimates the revenue and expenses for a specific period, often used for setting performance expectations.

Revenue and Spending Variance

The difference between the budgeted and actual amounts of revenue and expenditure over a specific period.

Net Operating Income

Income from a company's core business operations, excluding deductions of interest and taxes.

Q6: Based upon Ideko's Sales and Operating Cost

Q7: Which of the following statements is false?<br>A)

Q30: Anyone who purchases the stock on or

Q32: Which of the following statements is false?<br>A)

Q34: If its managers increase the risk of

Q36: When a company analyzes its short-term financing

Q37: Which of the following statements regarding long-term

Q41: Which of the following statements is false?<br>A)

Q43: Which of the following statements is false?<br>A)

Q46: In many Canadian firms,the corporate _ is