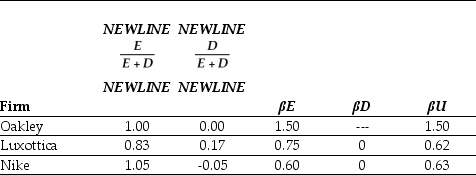

Use the table for the question(s) below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

-If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Nike is closest to:

Definitions:

Emotional Intelligence

The ability to understand one’s own emotions and the emotions of people with whom one interacts on a daily basis.

Interacts

The action of entities engaging with each other, influencing or having an effect on one another.

Problem-solving Ability

The capacity to analyze, assess, and resolve or mitigate problems through logical thinking and applied solutions.

Customer Loyalty

The degree to which a consumer consistently prefers and purchases a particular brand or product over competing ones.

Q9: Another to method to repurchase shares is

Q12: Which of the following statements is false?<br>A)

Q15: When managers _ the dividend,it may signal

Q19: Assume that you own 4,000 shares of

Q26: Your oil refinery will need to buy

Q29: Using the income statement above and the

Q34: Which of the following statements is false?<br>A)

Q35: Which of the following statements is false?<br>A)

Q45: The cash conversion cycle (CCC)is defined as<br>A)

Q47: Calculate the temporary working capital needs for