Use the information for the question(s)below.

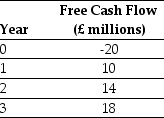

Luther Industries,a U.S.Corporation,is considering a new project located in Great Britain.The expected free cash flows from the project are detailed below:  You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

-Calculate the pound denominated cost of capital for Luther's project.

Definitions:

Q1: Consider a four-year,default-free bond with an annual

Q3: Which of the following statements is false?<br>A)

Q8: Based upon the average P/E ratio of

Q12: Which of the following statements is false?<br>A)

Q15: Consider the following equation: r<sub>wacc</sub> = r<sub>U</sub>

Q17: Which of the following statements regarding international

Q28: For most investors an investment in the

Q33: Luther Industries bills its accounts on terms

Q43: After the Irish taxes are paid,the amount

Q47: Which of the following statements is FALSE?<br>A)