Use the information for the question(s)below.

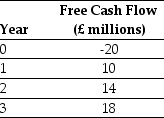

Luther Industries,a U.S.Corporation,is considering a new project located in Great Britain.The expected free cash flows from the project are detailed below:  You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

-What is the dollar present value of the project?

Definitions:

Collectivist Nature

A cultural characteristic where people prioritize group goals over individual interests.

Long-Term Orientation

A cultural dimension that describes a society's time horizon, focusing on future rewards, perseverance, and savings.

Legal System

The comprehensive system of rules and principles of a society that are recognized as binding and enforced by authorities.

Religious Scriptures

The sacred writings or holy texts of a religion, which convey spiritual truths, moral codes, and teachings integral to the faith's beliefs and practices.

Q3: Which of the following statements is false?<br>A)

Q4: A limited liability company is essentially:<br>A) a

Q11: Which of the following adjustments to net

Q22: Which of the following money market investments

Q27: Assuming that Ideko has a EBITDA multiple

Q29: If the ETF is currently trading for

Q54: Luther Corporation's stock price is $39 per

Q54: Aardvark's unlevered cost of equity is closest

Q63: Suppose that to fund this new project,Aardvark

Q65: Suppose that to fund this new project,Aardvark