Use the following information to answer the question(s) below.

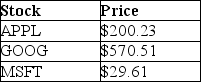

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of Apple Inc. (APPL) , one share of Google (GOOG) , and ten shares of Microsoft (MSFT) . Suppose the current stock prices of each individual stock are as shown below:

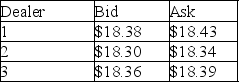

-Pfizer Inc.(PFE) stock is currently trading on the NYSE with a quoted bid of $18.35 and an ask price of $18.40.At the same time NASDAQ dealers are posting for following bid and ask prices for PHE:  Which of these NASDAQ represents an arbitrage opportunity when compared to the NYSE quotes?

Which of these NASDAQ represents an arbitrage opportunity when compared to the NYSE quotes?

Definitions:

Dividend Payout Ratio

A financial metric that measures the percentage of a company's net income that is paid out to shareholders in the form of dividends.

External Financing

Funds a business acquires from outside sources to finance its operations, including loans, issue of shares, bonds, and other financial instruments.

Maximum Capacity

The highest level of output that a company can sustain within a given period without compromising product quality or operational efficiency.

External Financing

Obtaining funds from outside sources, such as loans, stock issues, or bonds, to finance business operations or investments.

Q4: Which of the following statements is FALSE?<br>A)

Q9: After the Japanese taxes are paid,the amount

Q18: If Martin pays no premium to acquire

Q20: What rating must Luther receive on these

Q28: Which of the following statements is false?<br>A)

Q29: Luther Industries is offered a $1 million

Q40: How does a pyramid structure work?

Q45: Which of the following statements is false?<br>A)

Q68: Perrigo's price-earnings ratio (P/E)is closest to:<br>A) 15.96<br>B)

Q73: You have an $8,000 balance on your