Use the information for the question(s) below.

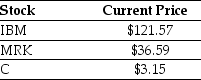

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks.Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM) ,three shares of Merck (MRK) ,and three shares of Citigroup Inc.(C) .Suppose the current market price of each individual stock are shown below:

-The price per share of the ETF in a normal market is closest to:

Definitions:

Horizontal Analysis

Financial analysis that compares an item in a current statement with the same item in prior statements in terms of the amount and percentage of change.

Base Year

A specific year chosen as a point of comparison for financial or economic data over time.

Current Position Analysis

The evaluation of a company’s ability to pay its current liabilities.

Short-Term Creditors

Entities or individuals who have provided financial credit to a company with the expectation of being repaid within a short period, usually within a year.

Q21: The incremental after tax cash flow that

Q35: You are considering purchasing a new home.You

Q37: Which of the following statements is false?<br>A)

Q39: Consider an investment that pays $1000 certain

Q41: In a normal market with transactions costs,is

Q41: Academic studies have supported the notion that

Q50: The effective annual rate (EAR)for a loan

Q65: Which of the following formulas regarding NPV

Q72: The amount that the price of bond

Q83: Assume that your capital is constrained,so that