Use the following information to answer the question(s) below.

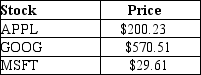

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks.Consider an ETF for which each share represents a portfolio of two shares of Apple Inc.(APPL) ,one share of Google (GOOG) ,and ten shares of Microsoft (MSFT) .Suppose the current stock prices of each individual stock are as shown below:

-The price per share of this ETF in a normal market is closest to:

Definitions:

Market Interest Rates

The prevailing rates at which borrowers can obtain loans and investors can receive returns in the financial market.

Bond Prices

The amount of money investors are willing to pay for bonds, inversely related to interest rate changes.

Yield

Return.

Rate of Return

The gain or loss on an investment over a specific period, expressed as a percentage of the investment's initial cost.

Q6: Luther Industries,a Canadian firm,has a subsidiary in

Q19: If the foreign tax rate is _

Q31: The IRR for Larry's three movie deal

Q35: Luther Industries is offered a $1 million

Q35: The YTM of a 3 year default

Q39: The difference between a firm's operating cycle

Q41: The statement of financial position is also

Q46: You are considering adding a microbrewery on

Q52: Wesley Mouch's auto loan requires monthly payments

Q73: You are trying to decide between three