Use the following information to answer the question(s) below.

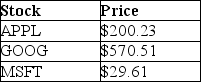

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of Apple Inc. (APPL) , one share of Google (GOOG) , and ten shares of Microsoft (MSFT) . Suppose the current stock prices of each individual stock are as shown below:

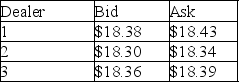

-Pfizer Inc.(PFE) stock is currently trading on the NYSE with a quoted bid of $18.35 and an ask price of $18.40.At the same time NASDAQ dealers are posting for following bid and ask prices for PHE:  Which of these NASDAQ represents an arbitrage opportunity when compared to the NYSE quotes?

Which of these NASDAQ represents an arbitrage opportunity when compared to the NYSE quotes?

Definitions:

Preemptive Right

A shareholder's right to buy new shares in a company before they are offered to the public, to maintain their proportionate ownership in the company.

Preemptive Right

The right granted to existing shareholders to purchase additional shares before the company offers them to the public, to maintain their proportional ownership.

Q2: If the current rate of interest is

Q10: In Canada,_ monitors potential monopoly combinations.<br>A) the

Q12: If Moon Corporation's gross margin declined,which of

Q23: Wyatt oil is considering drilling a new

Q36: Your firm purchases goods from its supplier

Q46: You are considering adding a microbrewery on

Q66: The internal rate of return (IRR)for project

Q75: In addition to the balance sheet,income statement,and

Q81: Which of the following statements is FALSE?<br>A)

Q100: The discount rate that sets the present