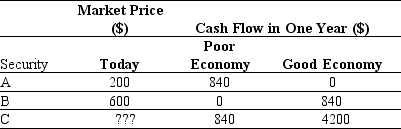

Use the table for the question(s) below.

-Suppose a risky security pays an average cash flow of $100 in one year.The risk-free rate is 5%,and the expected return on the market index is 13%.If the returns on this security are high when the economy is strong and low when the economy is weak,but the returns vary by only half as much as the market index,what risk premium is appropriate for this security?

Definitions:

Variable Manufacturing Overhead

The indirect, variable costs associated with manufacturing a product, which change in proportion to production volume.

Fixed Manufacturing Overhead

Refers to the regular, consistent expenses incurred in the operation of a manufacturing facility that do not vary with production volume, including salaries of permanent staff, rent, and insurance.

Predetermined Overhead Rate

A predetermined rate for assigning manufacturing overhead to products, calculated at the start of the period using estimated expenses and levels of activity.

Direct Labor-Hours

Total working hours of employees directly taking part in the production operation or service provision.

Q7: Which of the following money market investments

Q29: Which of the following statements is FALSE?<br>A)

Q35: What strategies are available to shareholders to

Q46: The payback period for project Alpha is

Q47: At an annual interest rate of 7%,the

Q49: Which of the following statements is false?<br>A)

Q60: Which of the following statements is FALSE?<br>A)

Q73: Which of the following is NOT an

Q76: Perrigo's market debt to equity ratio is

Q106: Which of the following statements is FALSE?<br>A)