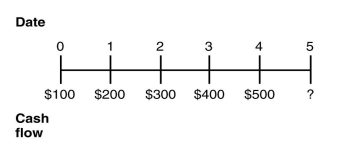

Consider the following timeline detailing a stream of cash flows:  If the current market rate of interest is 6%,then the future value of this stream of cash flows is closest to:

If the current market rate of interest is 6%,then the future value of this stream of cash flows is closest to:

Definitions:

Purchase Method

A method of accounting for an acquisition where the purchaser's financial statements include the assets and liabilities of the acquired company at their fair values.

Acquisition

The process of gaining control of another company or business entity through purchase or merger, often to expand operations or enter new markets.

Consolidated Buildings

Buildings and related assets that are combined into one entity for accounting and financial reporting purposes, typically within a group of companies.

Buildings (Net)

The value of a company's buildings after accounting for depreciation and impairment, reflecting the current value of these assets on the balance sheet.

Q13: What conditions cause the cash flows of

Q14: The amount of your original loan is

Q22: Hugh Akston took out a 30-year mortgage

Q30: If the risk-free rate of interest is

Q31: Luther Industries needs to borrow $50 million

Q36: In Canada,insider trading laws exist at _.<br>A)

Q59: What is Luther's net working capital in

Q60: The Sarbanes-Oxley Act (SOX)was passed by Congress

Q63: Which of the following statements is FALSE?<br>A)

Q70: A 30 year mortgage loan is a:<br>A)