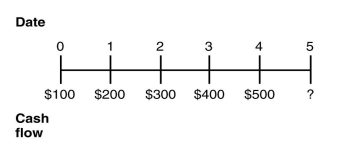

Consider the following timeline detailing a stream of cash flows:  If the current market rate of interest is 6%,then the future value of this stream of cash flows is closest to:

If the current market rate of interest is 6%,then the future value of this stream of cash flows is closest to:

Definitions:

Interest Rate Collar

A risk management strategy used to limit exposure to interest rate fluctuations by setting upper and lower bounds.

Risk Exposure

Risk exposure is the measure of potential future losses that may result from business activities or investment decisions, due to risks that have been taken.

Variable-Rate Loan

A loan in which the interest rate can change over time, based on an underlying benchmark interest rate or index.

Interest Rate Cap

A financial derivative contract that limits the maximum interest rate a borrower has to pay on a variable-rate loan.

Q2: Which of the following statements is false?<br>A)

Q17: Suppose that a young couple has just

Q33: Calculate the enterprise value for DM Corporation.

Q34: You are considering purchasing a new automobile

Q38: A project that you are considering today

Q45: If the current rate of interest is

Q53: You are considering investing in a zero

Q61: The effective monthly discount rate that you

Q70: You are up late watching TV one

Q79: The free cash flow for the first