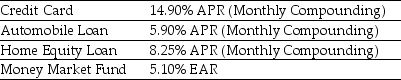

Use the table for the question(s)below.

Suppose you have the following Loans/Investments

-What is the effective after-tax rate of each instrument,expressed as an EAR?

Definitions:

Shares

Units of ownership interest in a corporation or financial asset that provide an equal distribution in any profits, if any are declared, in the form of dividends.

European Options

Financial derivatives that give the holder the right to buy or sell the underlying asset at a specified price only at the expiration date.

Black-Scholes Model

A mathematical model of the market for an equity, in which the price of the equity is modeled as a stochastic process, used primarily to price European style options.

Callable Bond

A callable bond is a type of bond that gives the issuer the right to repay the bond before its maturity date, at a predetermined call price.

Q3: Which of the following formulas is INCORRECT?<br>A)

Q21: Luther Corporation's total sales for 2009 were

Q22: Consider a zero-coupon bond with a $1000

Q32: The forward rate for year 3 (the

Q41: The yield to maturity for the three

Q50: The effective annual rate (EAR)for a loan

Q63: A key difference between sovereign default and

Q66: Interest on James Taggart's credit card balances

Q74: Suppose that when these bonds were issued,Luther

Q90: The price today of a 3 year