Use the table for the question(s)below.

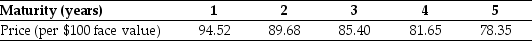

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value):

-Compute the yield to maturity for each of the five zero-coupon bonds.

Definitions:

E-business

The conduct of business processes on the internet, including buying and selling goods, servicing customers, and collaborating with partners.

Broader Concept

A general or wide-ranging idea or notion that encompasses numerous specific examples or instances.

Porter's Five Forces

A framework for analyzing a company's competitive environment and identifying the strengths and weaknesses of its current competitive position.

IT Infrastructure

The combination of physical hardware, software applications, networking assets, and services essential for the creation, functioning, and oversight of a corporate IT infrastructure.

Q3: Cash is a:<br>A) long-term asset.<br>B) current asset.<br>C)

Q9: Which of the following statements is FALSE?<br>A)

Q10: A company that manufactures copper piping is

Q20: Suppose an investment is equally likely to

Q32: Suppose you plan on purchasing Von Bora

Q45: Which of the following statements is FALSE?<br>A)

Q48: Gross profit is calculated as:<br>A) Total sales

Q54: Draw a timeline detailing the cash flows

Q57: An analysis that breaks the NPV calculation

Q85: If in 2009 Luther has 10.2 million