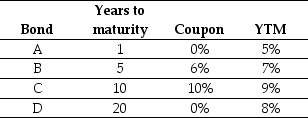

Use the table for the question(s) below.

Consider the following four bonds that pay annual coupons:

-Which of the four bonds is the most sensitive to a one percent increase in the YTM?

Definitions:

Shares

Units of ownership interest in a corporation or financial asset, providing a portion of the profits to shareholders in the form of dividends.

Dividend Preference

A feature of certain types of shares that entitles holders to receive dividends before common shareholders are paid.

Immediate Cash

Funds that are readily available for use without any delay or waiting period.

Uncertain Future

Describes the unpredictability or the lack of clarity regarding events or outcomes that will occur in time ahead.

Q6: Rearden's expected capital gains yield is closest

Q6: Which of the following statements is FALSE?<br>A)

Q25: When using the internal rate of return

Q26: Suppose an investment is equally likely to

Q44: The IRR for Galt Motors of manufacturing

Q46: Which of the following statements is FALSE?<br>A)

Q88: Rearden's expected dividend yield is closest to:<br>A)

Q93: Suppose that KAN's beta is 1.5.If the

Q99: Which of the following formulas is INCORRECT?<br>A)

Q101: Plot the zero-coupon yield curve (for the