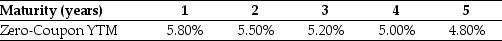

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The forward rate for year 4 (the forward rate quoted today for an investment that begins in three years and matures in four years) is closest to:

Definitions:

Coconut Consumption

The amount of coconut products, such as coconut water, meat, or oil, consumed by an individual or population.

Leisure

Time free from the demands of work or duty, when one can rest, enjoy hobbies, or engage in other personally satisfying activities.

Term Paper

A major assignment written by a student over an academic term, demonstrating their understanding of a topic.

Workbook Problems

Exercises and tasks found in a workbook intended to reinforce learning through practice.

Q7: The distinguishing feature of a corporation is

Q13: Assuming that Dewey's cost of capital is

Q25: When using the internal rate of return

Q53: Which of the following statements is FALSE?<br>A)

Q57: Dustin's Donuts experienced a decrease in the

Q63: If ECE's net profit margin is 8%,then

Q63: Which of the following statements is FALSE?<br>A)

Q82: The IRR for this project is closest

Q93: Which of the following statements is FALSE?<br>A)

Q96: Assuming that Defenestration's dividend payout rate and