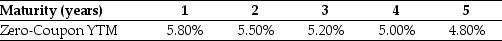

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The forward rate for year 5 (the forward rate quoted today for an investment that begins in four years and matures in five years) is closest to:

Definitions:

Physical Contact

The act of touching or being in close proximity to another person or object, which can have psychological and emotional effects.

Mother-Infant Attachment

The emotional bond that forms between a newborn and their primary caregiver, pivotal for the child’s social and emotional development.

Breast-Feed

The act of feeding a baby with milk directly from the mother's breasts, providing essential nutrients and antibodies.

Critical Period

A specific time during development when the presence or absence of certain experiences can have profound effects on future neurological and behavioral functioning.

Q13: If shareholders are unhappy with a CEO's

Q21: Which of the following statements is FALSE?<br>A)

Q22: How do we make adjustments when a

Q28: The price today of a three-year default-free

Q37: The price of a five-year,zero-coupon,default-free security with

Q49: Which of the following statements is FALSE?<br>A)

Q56: Which of the following statements is FALSE?<br>A)

Q79: Which of the following statements is FALSE?<br>A)

Q93: Which of the following statements is FALSE?<br>A)

Q97: Assuming that this bond trades for $1,112,then