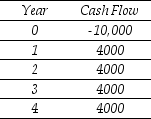

Use the table for the question(s) below.

Consider a project with the following cash flows in $:

-Assume the appropriate discount rate for this project is 15%.The IRR for this project is closest to:

Definitions:

NASDAQ

A global electronic marketplace for buying and selling securities, as well as the benchmark index for U.S. technology stocks.

Intranet

Computer network that is similar to the Internet but limits access to authorized users.

Investment Firms

Companies that invest pooled funds from clients, taking positions in various financial instruments for profit.

Corporate and Municipal Securities

Financial instruments issued by corporations and local government entities, respectively, to raise capital by borrowing from investors.

Q13: For the year ending December 31,2009 Luther's

Q26: Luther's quick ratio for 2008 is closest

Q36: Luther Corporation's stock price is $39 per

Q37: Suppose Novak Company experienced a reduction in

Q39: Taggart Transcontinental currently has a bank loan

Q55: You have an investment opportunity that will

Q59: The Volatility on Stock Y's returns is

Q59: Assume that you purchased General Electric Company

Q70: The depreciation tax shield for Shepard Industries

Q78: Given Nielson's current share price,if Nielson's equity