Use the information for the question(s)below.

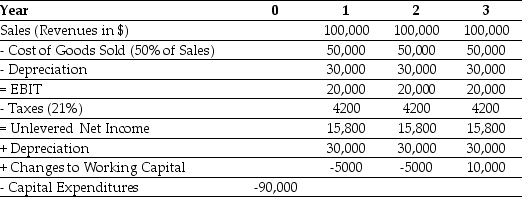

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projections:

-Epiphany would like to know how sensitive the project's NPV is to changes in the discount rate.How much can the discount rate vary before the NPV reaches zero?

Definitions:

Dyslexia

A learning disorder characterized by difficulty in reading due to problems identifying speech sounds and learning how they relate to letters and words.

Reading Comprehension

The ability to process text, understand its meaning, and to integrate it with what the reader already knows.

Fetal Alcohol Syndrome

A condition in a child that results from alcohol exposure during the mother's pregnancy, causing brain damage and growth problems.

Academic Functioning

Refers to the educational performance and the ability to meet the demands and expectations of academic environments.

Q22: Hugh Akston took out a 30-year mortgage

Q22: Suppose that the risk-free rate is 5%

Q33: Assuming that the film maker issues the

Q45: Assume that Kinston's new machine will be

Q59: An exploration of the effect on NPV

Q69: If a stock pays dividends at the

Q71: Consider the following timeline: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1624/.jpg" alt="Consider

Q93: Suppose that KAN's beta is 1.5.If the

Q100: California Gold Mining's beta with the market

Q122: Calculate the variance on a portfolio that