Use the information for the question(s)below.

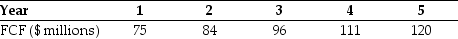

You expect DM Corporation to generate the following free cash flows over the next five years:  Beginning with year six,you estimate that DM's free cash flows will grow at 6% per year and that DM's weighted average cost of capital is 15%.

Beginning with year six,you estimate that DM's free cash flows will grow at 6% per year and that DM's weighted average cost of capital is 15%.

-If DM has $500 million of debt and 14 million shares of stock outstanding,then what is the price per share for DM Corporation?

Definitions:

Identical Preferences

The notion that two or more individuals value choices or outcomes in exactly the same way, having congruent likes and dislikes.

Productivity Factors

Elements that influence the efficiency and effectiveness with which resources are transformed into goods and services.

Highest Paying

Describing occupations or jobs that offer the most significant amount of monetary compensation.

Output Per Worker

A measure of productivity calculated by dividing the total output of goods or services by the number of workers.

Q10: The a<sub>i</sub> in the regression<br>A) measures the

Q11: If you take the $2,500 rebate and

Q11: Suppose that to raise the funds for

Q32: The weight on Lowes in your portfolio

Q33: Which of the following cash flows are

Q35: The NPV profile graphs:<br>A) the project's NPV

Q53: Suppose you plan on purchasing Von Bora

Q62: Wyatt Oil has a bond issue outstanding

Q80: If you hold 1,000 shares of Merck,then

Q104: The Volatility on Stock Z's returns is