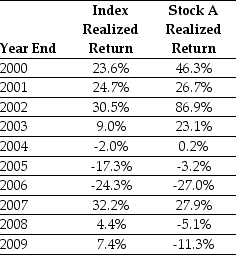

Use the table for the question(s) below.

Consider the following realized annual returns:

-Suppose that you want to use the 10-year historical average return on the Index to forecast the expected future return on the Index.The standard error of your estimate of the expected return is closest to:

Definitions:

Q2: Suppose that you are holding a market

Q9: Nielson Motors plans to issue 10-year bonds

Q25: Which of the following statements is FALSE?<br>A)

Q28: According to MM Proposition 1,the stock price

Q28: Which of the following is NOT a

Q51: Which of the following statements is FALSE?<br>A)

Q60: The highest effective rate of return you

Q63: Which of the following statements is FALSE?<br>A)

Q75: The firm's unlevered (asset)beta is:<br>A) the weighted

Q82: Which of the following statements is FALSE?<br>A)