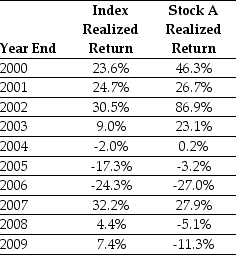

Use the table for the question(s) below.

Consider the following realized annual returns:

-Suppose that you want to use the 10-year historical average return on Stock A to forecast the expected future return on Stock A.The standard error of your estimate of the expected return is closest to:

Definitions:

Price Elasticity

The responsiveness of the quantity demanded or supplied of a good to a change in its price, commonly referred to in economics as price elasticity of demand or supply.

Quantity Demanded

The total amount of a good or service that consumers are willing to buy at a given price over a specified period.

Midpoint Formula

A method used in economics to calculate the percentage change in quantity demanded or supplied, given two points, by dividing the change by the midpoint between the two points.

Price Elasticity

An economic concept indicating the responsiveness of the quantity demanded of a product to changes in its price, with high elasticity indicating greater sensitivity.

Q4: What is a sunk cost? Should it

Q25: The expected return for Nielson Motors stock

Q36: When discounting dividends you should use:<br>A) the

Q45: Using the data provided in the table,calculate

Q63: Which of the following statements is FALSE?<br>A)

Q66: The beta for the risk free investment

Q83: The NPV for the trucking division is

Q92: The Sharpe ratio for your portfolio is

Q93: Which of the following statements is FALSE?<br>A)

Q101: The weight on Abbott Labs in your