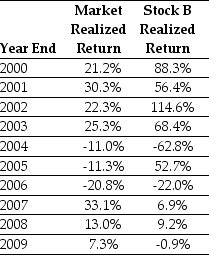

Use the table for the question(s)below.

Consider the following realized annual returns:

-Suppose that you want to use the 10 year historical average return on Stock B to forecast the expected future return on Stock B.Calculate the 95% confidence interval for your estimate of the expect return.

Definitions:

Put-call Ratio

A metric used to measure market sentiment by dividing the number of traded put options by the number of traded call options.

Breadth

The extent to which movements in the broad market index are reflected widely in movements of individual stock prices.

Confidence Index

Ratio of the yield on top-rated corporate bonds to the yield on intermediate-grade bonds.

Blue-chip Stock

Stocks of large, reputable, and financially sound companies with a history of reliable growth and dividend payments.

Q4: Suppose you plan to hold Von Bora

Q5: Which of the following statements is FALSE?<br>A)

Q21: Which of the following types of risk

Q22: Suppose the risk-free interest rate is 4%.If

Q33: Which of the following statements is FALSE?<br>A)

Q48: The effective annual rate for a certificate

Q53: Assume that the YTM increases by 1%

Q60: Suppose that you are holding a market

Q70: The depreciation tax shield for Shepard Industries

Q76: Which firm has the least market risk?<br>A)