Use the table for the question(s) below.

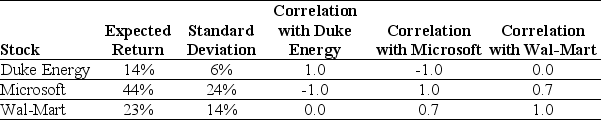

Consider the following expected returns, volatilities, and correlations:

-The expected return of a portfolio that is consists of a long position of $10000 in Wal-Mart and a short position of $2000 in Microsoft is closest to:

Definitions:

Negligence

The lack of appropriate care that a sensible person would have provided in comparable circumstances, leading to injury or detriment.

Causal Chain

A sequence of events where one event causes the next, leading to the final outcome.

Trespass to Personal Property

The act of unlawfully interfering with another person's possessions without consent.

Permission

Authorization granted by one party to another to do something that is otherwise not allowed or would be illegal without such authorization.

Q10: Consider a zero coupon bond with 20

Q26: Suppose an investment is equally likely to

Q28: Which of the following statements is FALSE?<br>A)

Q34: Which of the following questions is FALSE?<br>A)

Q44: Which of the following statements is FALSE?<br>A)

Q67: Which of the following is NOT an

Q69: Suppose over the next year Ball has

Q75: Which of the following types of risk

Q80: If Rockwood finances their expansion by issuing

Q97: Which of the following statements is FALSE?<br>A)