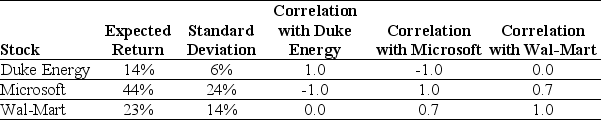

Use the table for the question(s) below.

Consider the following expected returns, volatilities, and correlations:

-The expected return of a portfolio that is consists of a long position of $10000 in Wal-Mart and a short position of $2000 in Microsoft is closest to:

Definitions:

Exercising

The activity of engaging in physical workouts or activities to improve health, fitness, and overall well-being.

Driving

The controlled operation and movement of a motor vehicle, including cars, motorcycles, trucks, and buses, on roads.

Northern Europe

A geographical and cultural region in the northern part of Europe, encompassing countries such as Denmark, Finland, Iceland, Norway, and Sweden.

Japan

An East Asian island nation characterized by its rich culture, technological advancements, and historical significance.

Q3: Which of the following formulas is INCORRECT?<br>A)

Q12: The risk premium for "Meenie" is closest

Q17: Assuming that Tom wants to maintain the

Q21: Taggart Transcontinental has a value of $500

Q25: Which of the following statements is FALSE?<br>A)

Q45: Assume that the S&P 500 currently has

Q59: The Volatility on Stock Y's returns is

Q60: A firm's net investment is:<br>A) its capital

Q75: Which of the following statements is FALSE?<br>A)

Q90: What is sensitivity analysis?