Use the table for the question(s) below.

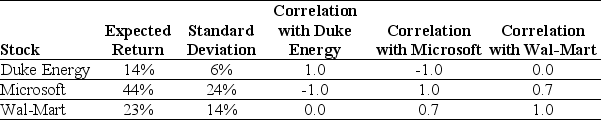

Consider the following expected returns, volatilities, and correlations:

-The volatility of a portfolio that is consists of a long position of $10000 in Wal-Mart and a short position of $2000 in Microsoft is closest to:

Definitions:

Ethical Compliance

Adherence to ethical standards and regulations set by professional bodies or legislation to ensure moral conduct in business practices.

Successfully Implemented

Refers to projects, initiatives, or strategies that have been executed effectively and have achieved their intended goals.

Pyramid Of Social Responsibility

A model that outlines a corporation's obligations to stakeholder groups in a hierarchical manner, prioritizing economic, legal, ethical, and philanthropic responsibilities.

Ethical And Socially Responsible

Being ethical and socially responsible means conducting business in a manner that is fair, ethical, and conscious of the broader community and environmental impact.

Q3: Which of the following formulas is INCORRECT?<br>A)

Q26: Assume that projects Alpha and Beta are

Q28: According to MM Proposition 1,the stock price

Q29: The tendency of uninformed individuals to overestimate

Q40: The variance of the returns on Stock

Q44: What is the excess return for the

Q62: Assume that Kinston's new machine will be

Q87: Which of the following statements is FALSE?<br>A)

Q92: Nielson Motors plans to issue 10-year bonds

Q95: What is the price today of a