Use the table for the question(s)below.

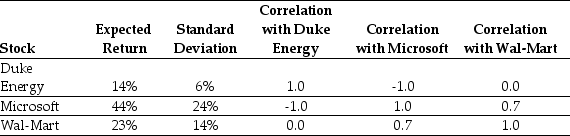

Consider the following expected returns,volatilities,and correlations:

-Consider a portfolio consisting of only Microsoft and Wal-Mart stock.Calculate the expected return on such a portfolio when the weight on Microsoft stock is 0%,25%,50%,75%,and 100%

Definitions:

Orlon

A synthetic fiber made from a polymer acrylonitrile, used primarily in textiles.

Poly(Acrylonitrile)

A polymer made from acrylonitrile monomers, commonly used in the production of synthetic fibers and plastics.

Hydrolyzed

A chemical process where a compound is broken down into smaller molecules by the addition of water.

Basic Conditions

Environments or solutions characterized by a pH greater than 7, often used in chemical reactions to promote specific outcomes.

Q6: Which of the following statements is FALSE?<br>A)

Q16: Suppose that Gold Digger's beta is -0.8.If

Q37: Which of the following statements is correct?<br>A)

Q40: The following equation: X = <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1624/.jpg"

Q51: The total market capitalization for all four

Q57: Which of the following investments had the

Q63: Which of the following statements is FALSE?<br>A)

Q78: Given Nielson's current share price,if Nielson's equity

Q79: California Gold Mining's required return is closest

Q92: Wyatt's annual interest tax shield is closest