Use the table for the question(s)below.

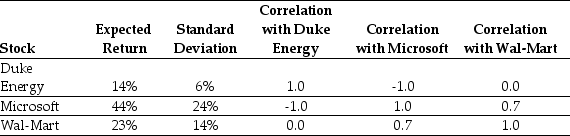

Consider the following expected returns,volatilities,and correlations:

-Consider a portfolio consisting of only Microsoft and Wal-Mart stock.Calculate the volatility of such a portfolio when the weight on Microsoft stock is 0%,25%,50%,75%,and 100%

Definitions:

Commitments

Promises or obligations that an individual has agreed to fulfill, often requiring dedication and hard work.

Abraham Maslow

An American psychologist known for creating Maslow's hierarchy of needs, a theory of psychological health predicated on fulfilling innate human needs in priority, culminating in self-actualization.

Theory

A set of principles on which the practice of an activity is based, or an idea used to account for a situation or justify a course of action.

Agreeableness

Agreeableness is a personality trait characterized by being kind, sympathetic, cooperative, warm, and considerate towards others.

Q4: If Rosewood had no interest expense,its net

Q16: Suppose that you are holding a market

Q32: Which firm has the highest cost of

Q35: Which of the following statements is false

Q36: Consider a corporate bond with a $1000

Q39: Which of the following is consistent with

Q58: If the Krusty Krab's opportunity cost of

Q63: Which of the following statements is FALSE?<br>A)

Q79: Prior to any borrowing and share repurchase,RC's

Q97: Which of the following statements is FALSE?<br>A)