Use the following information to answer the question(s) below.

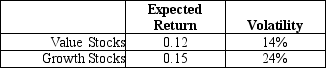

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The Sharpe ratio for the value stock portfolio is closest to:

Definitions:

Olive Oil

An oily substance extracted from the fruit of olive trees, which are native to the Mediterranean region, utilized in culinary practices, beauty products, medical formulations, soap making, and as a source of illumination in classic oil lamps.

Soybean Oil

An oil extracted from the seeds of the soybean plant, widely used for cooking and in food products.

Canola Oil

A vegetable oil derived from the seeds of the canola plant, known for its low content of saturated fat.

Reagent

A material or blend employed in chemical processes for the detection, quantification, analysis, or generation of different materials.

Q17: The depreciation tax shield for the Sisyphean

Q35: A type of agency problem that results

Q49: Luther's unlevered cost of capital is closest

Q53: Rearden Metal has a bond issue outstanding

Q53: Assume that in the event of default,20%

Q62: Which of the following statements is FALSE?<br>A)

Q62: Which of the following statements is FALSE?<br>A)

Q66: The incremental cash flow that Galt Motors

Q75: Which of the following statements is FALSE?<br>A)

Q84: What is the Beta for a type