Use the following information to answer the question(s) below.

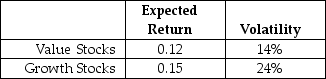

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk free rate is 3.5%.

The risk free rate is 3.5%.

-Which of the following statements is FALSE?

Definitions:

Fraudulent Coding

Incorrectly assigning medical billing codes to inflate billing or for services that were not rendered, often resulting in fraud.

Billing Practices

Procedures and policies used by healthcare providers and medical billing specialists to prepare and submit claims for healthcare services to insurers or patients.

Modifiers

In linguistics, words, phrases, or clauses that provide additional information about another word or phrase, altering its meaning. In the medical billing context, they are codes that alter the description of a procedure or service.

CPT Codes

Current Procedural Terminology codes, a set of medical codes used to describe medical, surgical, and diagnostic services to facilitate billing and documentation.

Q15: Which of the following statements is FALSE?<br>A)

Q18: Which of the following statements is FALSE?<br>A)

Q27: The cost of _ is highest for

Q27: Which of the following statements is FALSE?<br>A)

Q36: When discounting dividends you should use:<br>A) the

Q44: Which of the following statements is FALSE?<br>A)

Q52: Assume that THSI's cost of capital for

Q60: Which of the following statements is FALSE?<br>A)

Q74: The volatility of your of your investment

Q95: The expected return on security with a