Use the following information to answer the question(s) below.

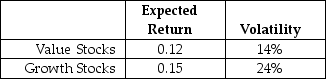

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk free rate is 3.5%.

The risk free rate is 3.5%.

-The Sharpe ratio for the market (which is a 50-50 combination of the value and growth portfolios) portfolio is closest to:

Definitions:

Services

Services are intangible actions or activities that one party provides to another, which do not result in the ownership of anything but can fulfill a need or provide satisfaction.

Par Common Stock

The nominal or face value assigned to common stock shares in the corporate charter, significant for legal and accounting purposes.

Par Preferred Stock

Preferred shares of a company that have a declared face value and potentially have priority over common stock in dividend distribution.

Shares

Shares represent an ownership stake in a company or financial asset, entitling the holder to a proportional share of profits, distributed as dividends, if announced.

Q4: What is a sunk cost? Should it

Q14: Assuming that your capital is constrained,which investment

Q21: Which of the following statements is FALSE?<br>A)

Q22: Calculate the total Free Cash Flows for

Q49: Prior to any borrowing and share repurchase,the

Q59: The Volatility on Stock Y's returns is

Q81: The continuation value for the trucking division

Q91: The free cash flow from Shepard Industries

Q98: Suppose that the managers at Rearden Metal

Q107: Consider an equally weighted portfolio that contains