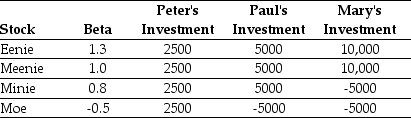

Use the table for the question(s) below.

Consider the following three individuals portfolios consisting of investments in four stocks:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then required return on Peter's Portfolio is closest to:

Definitions:

Nasogastric (NG) Tube

A medical device inserted through the nose down into the stomach to deliver food, medication, or remove stomach contents.

Abdominal Decompression

A medical procedure or treatment aimed at relieving increased pressure within the abdomen, which can compromise blood flow and organ function.

Gastric Suction

A procedure to remove the contents of the stomach, often using a tube inserted through the nose or mouth, for various medical reasons.

Water-Soluble Lubricant

A lubricating substance that dissolves in water, often used medically to ease insertion of devices or during examinations.

Q3: Suppose that MI has zero-coupon debt with

Q7: The NPV for Boulderado's snowboard project is

Q21: Monsters' required return is closest to:<br>A) 10.0%<br>B)

Q33: Which of the following statements is FALSE?<br>A)

Q66: You expect KT Industries (KTI)will have earnings

Q74: Assume that investors in Google pay a

Q77: What is the market portfolio?

Q81: Which of the following statements is FALSE?<br>A)

Q93: Which of the following statements is FALSE?<br>A)

Q107: What is the expected payoff to debt