Use the following information to answer the question(s) below

Assume that the risk-free rate of interest is 3% and you estimate the market's expected return to be 9%.

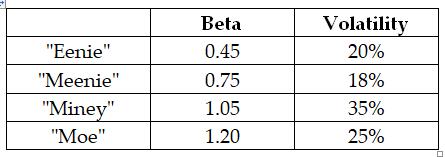

-Which firm has the most total risk?

Definitions:

Menu Costs

The costs incurred by firms in order to change their prices, including costs related to printing new menus, re-tagging items, or advertising new prices.

Inflation-induced Tax Distortions

Discrepancies in the effective tax burden caused by inflation, which can lead to distorted investment and consumption decisions.

Shoeleather Costs

Shoeleather costs are the metaphorical costs of inflation, referring to the time and effort spent trying to avoid holding onto cash as it loses value.

Real Interest Rate

The rate of interest an investor expects to receive after allowing for inflation.

Q36: Which of the following equations is INCORRECT?<br>A)

Q54: Which of the following statements is FALSE?<br>A)

Q61: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1624/.jpg" alt="The term

Q65: The incremental unlevered net income Shepard Industries

Q66: Your estimate of the debt beta for

Q68: Which of the following statements is FALSE?<br>A)

Q69: Rearden Metal has no debt,and maintains a

Q87: If the expected return on the market

Q100: The standard deviation of the returns on

Q108: Suppose that Google Stock has a beta