Use the following information to answer the question(s) below.

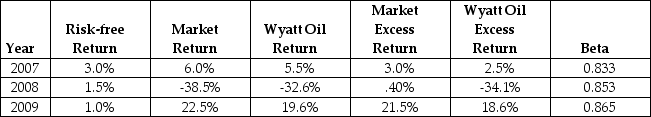

-Using the average historical excess returns for both Wyatt Oil and the Market portfolio,your estimate of Wyatt Oil's Beta is closest to:

Definitions:

Competitive Price-searcher

A firm operating in a market where it must search for the optimal price that balances its desire for profits with the need to remain competitive.

Long-run Equilibrium

A state in which all firms in a market are making zero economic profit, leading to an optimal allocation of resources.

Competitive Price-searcher

A market participant who sets prices through active search and strategy, often in markets with some degree of product differentiation.

Q2: Galt's asset beta (ie the beta of

Q2: Assume that in the event of default,20%

Q13: Which of the following statements is FALSE?<br>A)

Q17: Assuming that Tom wants to maintain the

Q32: If your new strip mall will have

Q37: Assume that investors in Google pay a

Q70: If Flagstaff currently maintains a debt to

Q73: The incremental EBIT for Shepard Industries in

Q77: Wyatt Oil just reported that a major

Q84: Luther Industries has a market capitalization of