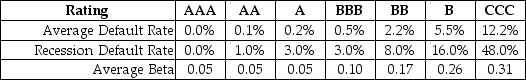

Use the following information to answer the question(s) below.Consider the following information regarding corporate bonds:

-Galt Industries has a market capitalization of $50 billion,$30 billion in BBB rated debt,and $8 billion in cash.If Galt's equity beta is 1.15,then Galt's underlying asset beta is closest to:

Definitions:

Wealth Distribution

The manner in which wealth is allocated among individuals or groups within a society.

Community Power Debate

Debate in the field of political science about the nature of power that existed in society. The two camps in the debate were the elitists and the pluralists.

Privileged

Enjoying special rights, advantages, or immunities not available to others.

Power

The ability or capacity to direct or influence the behavior of others or the course of events, often seen in personal relationships, organizations, and societal structures.

Q17: Which of the following statements is FALSE?<br>A)

Q18: The expected return for Alpha Corporation is

Q33: Calculate the enterprise value for DM Corporation.

Q36: Which of the following agency problems represents

Q57: Which of the following investments had the

Q58: The alpha for Bernard is closest to:<br>A)

Q64: The Grant Corporation is considering permanently adding

Q79: Which of the following statements is FALSE?<br>A)

Q87: Assume that Omicron uses the entire $50

Q87: Suppose that you have invested $100,000 invested