Use the following information to answer the question(s) below.

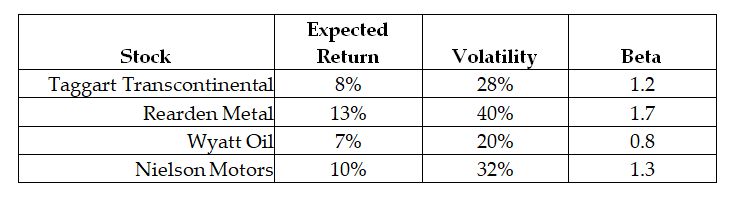

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New information arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

-The expected alpha for Taggart Transcontinental is closest to:

Definitions:

Deviant

Behavior or actions that deviate from the societal norms or expectations, often considered unacceptable or aberrant.

Racial Profiling

The discriminatory practice by law enforcement officials of targeting individuals for suspicion of crime based on the individual's race, ethnicity, religion, or national origin.

Routine Vehicle Inspections

Mandatory checks performed on vehicles to ensure that they conform to regulations governing safety, emissions, or both.

Gender Differences

The distinctions in characteristics, roles, behavior, and social expectations based upon one's gender.

Q2: Galt's asset beta (ie the beta of

Q12: In 2005,the effective tax rate for debt

Q51: The date on which the board authorizes

Q52: Suppose you are a shareholder in d'Anconia

Q61: Two separate firms are considering investing in

Q62: Calculate Rockwood's stock price following the market

Q64: Suppose that MI has zero-coupon debt with

Q68: The beta for security "X" is closest

Q68: Which of the following statements is FALSE?<br>A)

Q70: If Nielson's equity cost of capital is