Use the following information to answer the question(s) below.

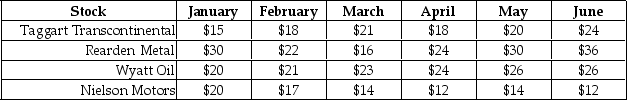

Consider the price paths of the following stocks over a six-month period:  None of these stocks pay dividends.

None of these stocks pay dividends.

-Assume that you are an investor with the disposition effect and you bought each of these stocks in January.Suppose that it is currently the end of March,which stocks are you most inclined to sell? 1.Taggart Transcontinental

2.Rearden Metal

3.Wyatt Oil

4.Nielson Motors

Definitions:

Economic Profits

The difference between a firm's total revenue and its total expenses, including both explicit and implicit costs.

Product Price

The amount of money required to purchase a specific product or service.

Production Capacity

The maximum output that a business can produce in a given period under normal conditions.

Consumers' Desire

The inclination or preference of consumers towards certain goods, services, or experiences.

Q5: What is the variance on a portfolio

Q22: The firm's unlevered (asset)cost of capital is:<br>A)

Q40: Assume that investors hold Google stock in

Q57: What is the expected payoff to equity

Q62: Calculate Rockwood's stock price following the market

Q79: The total amount available to payout to

Q80: Which of the following statements is FALSE?<br>A)

Q85: If Rockwood is able to repurchase shares

Q93: Which of the following statements is FALSE?<br>A)

Q96: The standard deviation of the return on