Use the following information to answer the question(s) below.

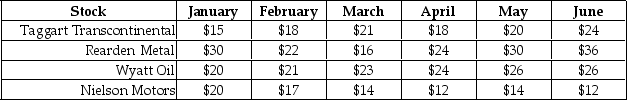

Consider the price paths of the following stocks over a six-month period:  None of these stocks pay dividends.

None of these stocks pay dividends.

-Assume that you are an investor with the disposition effect and you bought each of these stocks in January.Suppose that it is currently the end of June,which stocks are you most inclined to hold? 1.Taggart Transcontinental

2.Rearden Metal

3.Wyatt Oil

4.Nielson Motors

Definitions:

Ratio Analysis

A financial analysis technique that uses ratios derived from financial statements to assess a company's performance and financial health.

Negative Figure

A value less than zero, often indicated in financial statements to represent losses, deficits, or outflows.

Comparative Balance Sheets

Financial statements that provide a side-by-side comparison of a company's financial position at different periods.

Horizontal Analysis

A financial analysis technique that compares historical financial data over a series of reporting periods to identify trends and growth patterns.

Q4: Which of the following statements is FALSE?<br>A)

Q35: Assume that Omicron uses the entire $50

Q50: Assume that Omicron uses the entire $50

Q57: Which of the following investments had the

Q66: The Debt Capacity for Iota's new project

Q73: If Flagstaff currently maintains a .8 debt

Q73: Which of the following statements is FALSE?<br>A)

Q83: Suppose that Defenestration decides to pay a

Q111: What is the expected payoff to equity

Q131: Which of the following statements is FALSE?<br>A)