Use the information for the question(s) below.

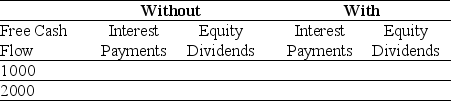

Consider two firms: firm Without has no debt, and firm With has debt of $10,000 on which it pays interest of 5% per year. Both companies have identical projects that generate free cash flows of $1000 or $2000 each year. Suppose that there are no taxes, and after paying any interest on debt, both companies use all remaining cash free cash flows to pay dividends each year.

-Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows:

Definitions:

Establish Goals

The act of defining clear, achievable objectives intended to guide actions or behaviors.

Time-Management Skills

Refers to the ability to use one's time effectively or productively, especially at work or in daily activities.

Short-Term Goal

An objective set to be achieved in the near future, often serving as a step towards a longer-term goal.

Data Scientist

A professional who uses statistical, mathematical, and computational methods to analyze and interpret large data sets.

Q4: Which of the following statements is FALSE?<br>A)

Q7: The expected return on security "Y" is

Q13: If the risk-free rate is 3% and

Q16: Suppose that Defenestration decides to pay a

Q30: FBNA's EBIT is closest to:<br>A) $43 million<br>B)

Q74: The Debt Capacity for Omicron's new project

Q81: What is the expected value of Rearden's

Q83: Suppose that Defenestration decides to pay a

Q87: Luther Industries is considering borrowing $500 million

Q92: Suppose Luther Industries is considering divesting one