Use the information for the question(s) below.

KD Industries has 30 million shares outstanding with a market price of $20 per share and no debt. KD has had consistently stable earnings, and pays a 35% tax rate. Management plans to borrow $200 million on a permanent basis through a leveraged recapitalization in which they would use the borrowed funds to repurchase outstanding shares.

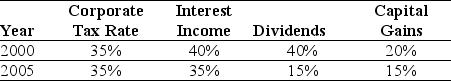

-Assume the following tax schedule:

Personal Tax Rates

Considering the effect of personal taxes,calculate the PV of the interest tax shield provided by KD's recapitalization in 2005.

Considering the effect of personal taxes,calculate the PV of the interest tax shield provided by KD's recapitalization in 2005.

Definitions:

Individualized Consideration

A leadership approach that involves recognizing and addressing the unique needs, strengths, and aspirations of each follower.

Charisma

A compelling attractiveness or charm that can inspire devotion in others, often seen as a leadership quality.

Mood Contagion

The phenomenon where an individual's mood can spread to others in their environment.

Affects Behavior

Influences or changes the way individuals act or conduct themselves.

Q10: The a<sub>i</sub> in the regression<br>A) measures the

Q19: Which of the following statements is FALSE?<br>A)

Q21: The depletion of the world's fisheries is

Q27: Assuming that Tom wants to maintain the

Q35: The bottom of a lake or stream

Q40: The following equation: X = <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1624/.jpg"

Q46: What is the variance on a portfolio

Q49: Which of the following statements is FALSE?<br>A)

Q64: The unlevered value of Rose's acquisition is

Q71: Assume that you are an investor with