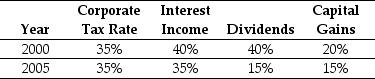

Use the table for the question(s) below.

Consider the following historical top federal tax rates in the United States:

Personal Tax Rates

-In 2000,assuming an average dividend payout ratio of 50%,the effective tax advantage for debt (t*) was closest to:

Definitions:

Adenosine

A chemical found in the body that plays a role in promoting sleep and suppressing arousal, and is also a component of RNA.

Acetylcholine

A neurotransmitter in the nervous system that plays a critical role in muscle contraction and the modulation of alertness, memory, and learning.

Norepinephrine

A neurotransmitter and hormone important in the body's response to stress, affecting attention, heart rate, and other physiological functions.

Histamine

An organic nitrogenous compound involved in local immune responses, as well as regulating physiological functions in the gut and acting as a neurotransmitter.

Q7: Which of the following countries is the

Q17: Based upon Ideko's Sales and Operating Cost

Q23: The term ε is a(n):<br>A) measure of

Q26: The expected return for the fad follower's

Q39: The amount of money that Galt's fund

Q39: The Debt Capacity for Omicron's new project

Q44: Which of the following stocks represent selling

Q53: Rearden Metal has a bond issue outstanding

Q62: Calculate Rockwood's stock price following the market

Q66: Assume that the corporate tax rate is